Financial Education

How to use mobile payment apps

In this article

- Digital apps make transactions easy and are a simplified form of payment.

- PayPal®, Venmo®, Cash App® and Zelle® are the top four payment apps.

- Follow our helpful tips to be safe when using these apps.

Peer-to-peer (P2P) mobile payment apps let people send and receive money electronically. People are increasingly using these apps because they’re fast, convenient and easy to set up and use. If you’re new to how these apps work, keep reading to:

- Get to know the big four: PayPal®, Venmo®, Cash App® and Zelle®.

- Learn about important safety and security precautions.

- Understand why you should use debit for your app’s payment method.

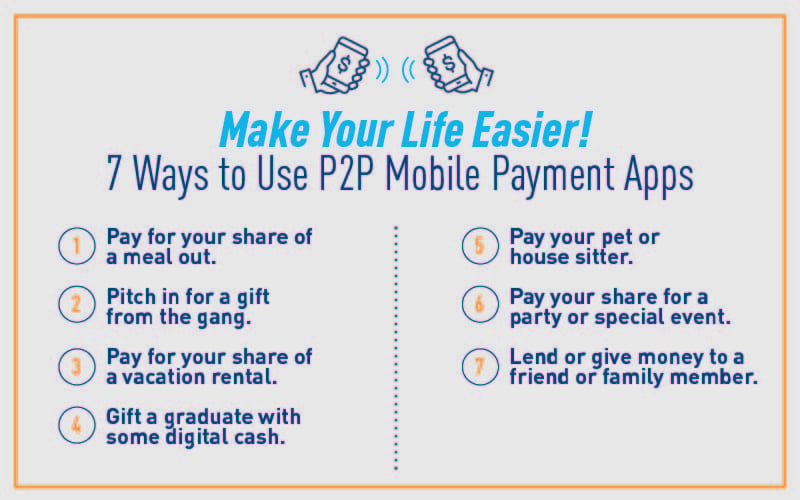

- Check out eight ways to use P2P mobile payment apps to make your life easier.

You’ve been there before — dining out with a large group. It’s a great time until the bill comes, and everyone awkwardly pulls out their wallets. How do you pay?

- Give cash to whoever foots the bill or throw down cash to pay for what you owe.

- Tally up what everyone ordered on the back of the receipt. All parties mark down their total and card number. (The server loves this one.)

- Throw in everyone’s cards and split the bill, which always ends up being unfair to those who skipped drinks and appetizers.

With the emergence of peer-to-peer payment apps, these payment methods are history. Mobile payment apps (or cash apps) make it easy to pay someone for what you owe and request and receive money. Whether it’s your portion for the Airbnb you’re splitting with family, your half the rent or a reimbursement to friend for the money you borrowed, it’s never been easier to transfer that money. So, what are these cash apps, and how do they work?

Let’s talk about how these easy apps work

Sounds easy, huh? Here’s why: Payment apps provide streamlined electronic transactions between people. Link your bank account, or your debit or credit card, to the app. You may also be able to use funds from the balance on the app. If you’re an over spender, using debit may be the preferred option for avoiding debt, potential fees and the growing interest that comes with credit.

Next, you’ll search for the recipient by phone number, email address, username or even Facebook (if you choose to sync to that social platform). From there, simply fork over the funds!

Don’t have the app yet? Getting it is also simple! Search for and download the app, sign up for an account and follow the prompts, including any steps for verification and passwords to increase security.

The four most common payment apps

PayPal®, Venmo®, Cash App® and Zelle® are among the top P2P apps people use. There are several contactless payment apps, but apps like these are less inclusive. The big four can be more convenient because they’re more universal. Just make sure the recipient also has the same payment app you're using set up before trying to send funds.

PayPal®

PayPal® arguably reigns as king of P2P payment apps. It dates back to 1998 when it was founded as a money transfer service for online vendors and customers. Known for revolutionizing this type of payment processing, PayPal® was bought by eBay in 2002 and skyrocketed in popularity around the globe as a growing number of people use PayPal® for personal transactions. It’s also a large commerce platform where merchants can do business with customers while managing their cash flow.

Venmo®

This app is so popular that it’s coined the phrase “just Venmo® me!” Not only is PayPal®-owned Venmo a P2P mobile payment app, but it’s also a social network. Send a memo line and emoji with your payment and select Public to enable the feed where everyone can see who’s paying whom for what. Through this broadcast, requesting and sending money becomes a social experience.

Cash App®

Cash App® is another P2P mobile platform allowing users to send, receive and bank funds. At the same time, it takes the next step by offering direct deposit and investing. Users can by and sell stocks, ETFs and select cryptocurrency, or they can access high-yield savings accounts. It puts these tools conveniently at your fingertips, all with the functionality of a P2P payment system.

Zelle®

Zelle® is a popular peer-to-peer (P2P) payment service that makes sending and receiving money between bank accounts fast and easy. It only takes a few minutes for funds to be directly transferred. Just make sure that the recipient also has Zelle® set up before trying to send funds.

If you didn’t know, Desert Financial will have Zelle® soon! We’re committed to offering it in Online Banking and our mobile app this summer. If you’re looking for a P2P payment option you can use in Online Banking or the mobile app in the meantime, we have PayItNow —a tool that allows you to send funds to almost anyone with an email address or mobile phone number. And they don’t need to be a Desert Financial member!

Also, please note that the standalone Zelle® app has retired and is no longer a P2P payment option.

What about Apple Pay® and Apple Cash®?

Apple Pay® and Apple Cash® can be extremely convenient if your peers have Apple devices because it uses your digital wallet to send money to them. It also allows you to transfer an Apple Cash® balance to your bank account in one to three days.

Another way Apple Cash® sets itself apart is with its ease of use. Just like a debit card or credit card, your Apple Cash® card lives in your digital wallet and can be used to pay at restaurants, grocery stores, convenience stores and more.

Are P2P mobile payment apps safe to use?

Consumer Reports calls these apps “a convenient and easy way to send money to others” but also warns the risks of consumers losing money if they fall victim to fraud or sending money to the wrong person.1 For popular apps PayPal®, Venmo®, Cash App® and Zelle®, they ensure the safety and security of their services.

Safety to remember

- Only send money to someone you know or trust.

- Always double-check the amount being sent before submitting a payment. Once sent, you are not guaranteed the funds back.

- Beware of common payment scams like romance scams or overpayment scams.

- Use strong and unique passwords for each mobile payment/P2P app you use.

- Only use P2P apps to send money while connected to a secure Wi-Fi network.

PayPal®

The platform’s robust security features for buyers and sellers can ease user concerns. It helps eliminate any risk by not sharing full financial information with sellers, monitoring transactions 24/7, using encryption technology and offering Purchase Protection.

Security tip: PayPal® will never ask for confidential information via email!

Venmo®

Venmo also uses encryption for account protection, as well as stores information on secure servers and monitors account activity.

Security tip: Venmo® will never contact you to request a password or verification code. Look for “https:” and a lock symbol next to the URL to verify encryption. You can also click on Settings > Security to log out of any devices and add another layer of protection by setting up a PIN.

Cash App®

Cash App® encrypts data and uses fraud detection to protect your money and data, but it’s still a good idea to know how to shield yourself from fraud. Secure your device physically and with a passcode. Also, while you should feel confident using the app, always look out for scams, and be 100% certain about who you’re sending money to.

Zelle®

Because Zelle® moves money instantly, you’ll want to make sure you’re sending money to someone whom you trust and that the recipient’s contact information is correct. Zelle® also advises that users be aware of scams and avoid deals that sound too good to be true. For more information on security, check out www.Zellepay.com/pay-it-safe.

Keep in mind, like with all financial services, there are risks. Make sure to read up on the precautions your app is taking and only send/receive money with people whom you know and trust. It is advantageous to use a password generator, change your password frequently and monitor your account.

Millennials are known to have led the mobile payment revolution. As usage rapidly grows, other generations are catching on to it. Are you a newbie to digitally transferring money? Check out the big three mentioned in this article and transform how you share money!

Debit card safety & security

At Desert Financial, your Visa® Debit Card is fraud-protected and we act quickly to resolve qualified fraud claims. To protect your debit card, review your checking account regularly, report fraudulent charges or lost/stolen cards immediately, keep your debit card in your possession at all times, protect your PIN and only use your debit card with trusted vendors.

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.

Disclosures

1

https://www.consumerreports.org/media-room/press-releases/2023/01/consumer-reports-finds-peer-to-peer-payment-apps-offer-ease-and-convenience-but-pose-potential-financial-and-privacy-risks-for-users/

PayPal, Venmo, Zelle, Google Pay, Apple Pay and Facebook Pay are non-affiliated third-parties of Desert Financial Credit Union. Desert Financial makes no warranties or representations about the goods or services offered.